north carolina estate tax return

The state income tax rate is 525 and the sales tax rate. Then print and file the form.

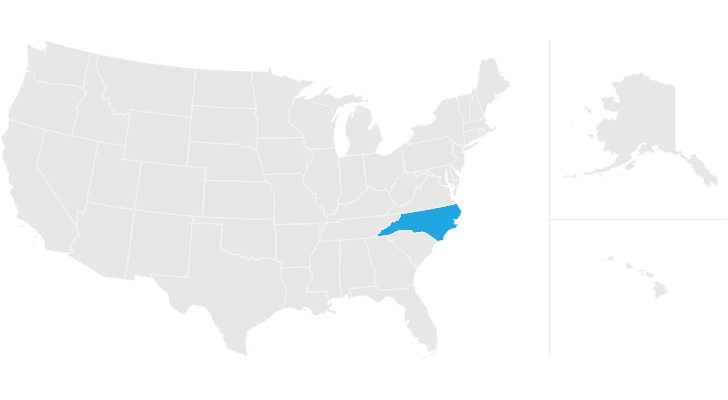

A Guide To North Carolina Inheritance Laws

PDF 1874 KB - November 27 2017 Estates and Trusts Fiduciary Partnerships Individual Income Tax.

. Federal estate tax return. When and Where to File-- A North Carolina Estate Tax Return must be filed with the North Carolina Department of Revenue at the same time the federal estate tax return is due which. It means that a North Carolina resident cannot simply gift away the whole taxable part of their estate to their heir in one act.

11 opening for Corporate returns and Feb. Strategies to legally avoid eliminate the North Carolina estate tax. Property Tax - Forms Property Tax - Forms Taxes Forms.

Affidavit Of Notice To Creditors. 1 for Estates Trust will begin receiving acknowledgements for eFiled returns on the respective start dates. PO Box 25000 Raleigh NC 27640-0640.

Link is external 2021. The state exemption amount was tied to the federal one which means that for deaths in. Sales and Use Tax.

The tax rate ranges from 116 to 12 for 2022. The agency began accepting Estate Trust tax returns on Feb. In North Carolina include a complete copy of Federal Form 706.

Reopen the estate after probate is closed Notice to beneficiaries that they are named in a will. Tax Bulletins Directives Important Notices. 246 signed by Governor Cooper on January 7 2022.

Beneficiarys Share of North Carolina Income Adjustments and Credits. A married couple can gift away up to 32000 to. Application for Extension for Filing Estate or Trust Tax Return.

Previous to 2013 if a North Carolina resident died with a large estate it might have owed both federal estate tax and a separate North Carolina estate tax. Form D-407 Income Tax for Estates and Trusts must be filed for an estate for the period from the date of death to the end of the taxable year if the estate had taxable income from North Carolina sources or income which was for the benefit of a North Carolina resident and the estate is required to file a federal tax return for. But circumstances can quickly change.

Due by April 15 of the year following the individuals death. The federal taxable income of the fiduciary is the starting point for preparing a North Carolina Income Tax Return for Estates and Trusts Form D-407 and requires the same additions and deductions. Form 8971 Information Regarding Beneficiaries Acquiring Property From a Decedent.

The federal gift tax has an annual exemption of 16000 per recipient. The state of North Carolina requires you to pay taxes if you are a resident or nonresident that receives income from a California source. You may not believe you have a problem but that doesnt mean.

North Carolina Capital Gains Tax. Affidavit Of Collection Disbursement And Distribution. NC K-1 Supplemental Schedule.

Affidavit For Collection Of Personal Property Of Decedent. What Is North Carolina Estate Tax. Form 1041 Income Tax Return for Estates.

Of all the states Connecticut has the highest exemption amount of 91 million. You may not have an estate tax problem at this point in your life. Starting in 2023 it will be a 12 fixed rate.

Form 706 Federal Estate Tax Return. Allocation of Income Attributable to Nonresidents. North Carolina Department of Revenue.

Estates and Trusts Fiduciary. Effective January 1 2013 the North Carolina legislature repealed the states estate tax. Box 2448 Raleigh NC 27602.

Up to 25 cash back Update. Prior to January 1 1999 North. North Carolina Administrative Office of the Courts Judge Marion R.

Complete this version using your computer to enter the required information. North Carolina Estate Planning Law Firm. This is required only of individual estates that.

An addition is also required for the amount of state local or foreign income tax deducted on the federal return. Estate Trusts. Taxpayers who filed before the Jan.

Form 706 Federal Estate Tax Return. 34 -20 days year over year Median Rent Price. Waiver Of Personal Representatives Bond.

The estate tax rate is based on the value of the decedents entire taxable estate. If youve made a gift to a trust you should consider filing a gift tax return to avoid estate taxes. PO Box 25000 Raleigh NC 27640-0640.

In other words you can make up to 16000-worth gifts to as many people as you wish every year. Federal estatetrust income tax return. Sale of real estate or stock foreclosure of deed of trust etc must be reported on the.

Skip to main content Menu. North Carolina Department of Revenue. For calendar year filers the tax filing deadline this year is Thursday April 15.

North Carolina Estate Tax Return - 2000. 2020 D-407 Estates and Trusts Income Tax Return. Income of the estate property acquired by the estate after the decedents death or asset conversions eg.

Take a look at the table below. The North Carolina estate tax is equal to the amount of credit allowed for State death taxes paid on the federal estate tax return Form 706. 10488084 latest estimate by the US.

1999 Form A-101 North Carolina Estate Tax return Use this form only if death occurred on or after January 1 1999 Files. If the decedent owned property in two or more states the credit must be prorated between those states by completing Schedule Z below. North Carolina Department of Revenue.

Due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine-month period. PO Box 25000 Raleigh NC 27640-0640. Owner or Beneficiarys Share of NC.

PDF 33315 KB - December 30 2019. Inventory for Decedents Estate Form AOC-E-505. North Carolina does not exempt nonresidents from state income tax.

North Carolina Tax Rates Rankings Nc State Taxes Tax Foundation

Best Realtors In Reidsville Nc North Carolina Real Estate Property For Rent Property Management

Top 10 Best Places To Retire In North Carolina Smartasset

![]()

Estate Tax What Is The Current Estate Tax Exemption Carolina Family Estate Planning

A Guide To North Carolina Inheritance Laws

North Carolina State Taxes 2022 Tax Season Forbes Advisor

North Carolina Nc Car Sales Tax Everything You Need To Know

How The Flat Tax Revolution Of 2022 Was Sparked In North Carolina

North Carolina Estate Tax Everything You Need To Know Smartasset

Murphy North Carolina North Carolina Beaches Visit North Carolina Living In North Carolina

North Carolina Sales Tax Small Business Guide Truic

North Carolina Estate Tax Everything You Need To Know Smartasset

Videos Captured On Social Media Show Initial Impact Of Hurricane Florence Hurricane Florence North Carolina Coast

What Is The Value Of My Home Ballantyne Nc 28277 Nc Real Estate Estate Homes Real Estate

The Ultimate Guide To North Carolina Real Estate Taxes

Where Is My Nc Tax Refund The State Said A Delay Pushed Back The Refunds But Hopes All Will Be Completed By End Of April Abc11 Raleigh Durham

Voice Of Hope December 2010 North Carolina Homes Murphy Nc North Carolina Mountains